In my last post I talked about the idea of “deliberate descent” as a response to the challenges facing us in the age of scarcity. Most of what I covered amounts to “relocalization”, which seems to operate mainly a community level. But there are a lot of things individuals and families can do to prepare for and adapt to the age of scarcity.

Most of us are going to experience a significant decrease in our level of prosperity – to put it simply, we’re going to get poorer. Might as well call this “involuntary descent”. In our society there is a real stigma attached to being poor, and our initial reaction is to try to keep up appearances, to put off admitting our situation until we have absolutely no choice.

The essence of “voluntary descent” is to acknowledge what is coming, to admit that we are not going to be exempt from it, and to take steps to adapt in advance while we still have the resources to do so. Such adaptations will surely be more effective than if we wait until we are backed into a corner with no choices, no remaining resources and no skills at living in a very different way than we have customarily done for most of our lives. Now is the time to develop those skills and the new ways of thinking that go with them.

During the age of growth money could be counted on to make money. This was based on the fact that the economy was growing, and businesses wishing to expand their operations were looking to borrow money and willing to pay lenders for the privilege of doing so. In retrospect it’s starting to look like this actually ended in the mid-90’s, and since then all the “growth” has been in the shape of financial bubbles which have grown and burst one after another while the real economy stood still or declined. One of the reasons bubbles are so easy to get started is that there is still a lot of money looking for a place to grow, so to speak – or rather, people desperate for a place to invest that will still provide the level of returns they became accustomed to before growth came to an end.

I am not really addressing this blog to the sort of people who make a fortune investing their wealth (the 1%, or the “rentier class” as they are sometimes called). Nor do I feel a lot of sympathy for them, but it’s clear that the idea of deliberate descent is going to be pretty foreign to such folks and a very hard adaptation to even consider. They are liable to be left behind, still struggling to make business as usual work like it used to.

Also hard hit are those of us who, after a life of real, productive work, planned to retire and live off our invested savings, or on a pension, which amounts to the same thing. If you have direct control over your savings you probably took a fairly substantial loss in 2008, and since then you’ve likely been disappointed by earnings in an economy that is supposedly "recovering". So, do you focus on adapting to living with less (deliberate descent), or buy into the latest bubble’s promise of higher returns? Remember that every bubble promises that “it will be different this time”, and then bursts just like all the other bubbles – if things sound too good to be true, they probably are (too good, that is). I don’t recommend investing in precious metals either – despite all the talk about them being superior to so called “fiat currencies”, the worth of metals like silver and gold is largely a matter of people having confidence in them, just like paper money.

If, like me, you are relying on a pension you are pretty well tied in to the decisions made by the fund managers. And dependent on them for information on the long term outlook of that fund. I have to say the annual reports I have been reading are pretty honest, except that they are clearly written by people who believe that economic recovery is just around the corner, if not already happening. Without such a recovery, the prospects for the pension fund I rely on are pretty bleak. Now as it happens this pension is guaranteed by the provincial government and we have always believed that things would have to get pretty bad before the government would welsh on the deal. But it is becoming clear to me that at some point throwing “fat cat pensioners” to the wolves will become politically expedient. At that point I expect my pension to be discounted to 70%, 50% or perhaps even less. At some point, it will probably disappear altogether. For many of my fellow pensioners this will come as a horrendous shock. Clearly, the time to prepare is now.

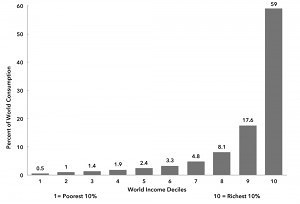

During this sort of financial discussion, people often get into an argument over whether the current financial mess will lead to runaway inflation or continued deflation. If you think that the current economic situation is mainly a money problem, you’ll be worried about hyperinflation caused by governments printing too much money to cope with their debts. On the other hand, if you’re like me and think that the end of cheap energy is what’s hurting the economy, you would expect a continued deflationary trend. Economic growth is over, indeed the economy will continue to shrink until it reaches a size that can be operated on renewable energies – probably 10% to 20% of its present size, depending on how ineptly we handle the change. At the same time, we can expect the price of necessities which are based on cheap fossil fuels to keep on going up, until we can find a way to replace those necessities with alternatives that are not fossil fuel based.

I think it is important to get and keep a firm grasp on what wealth really is. Not money, that’s certain. Wealth comes in two forms. First, possession of real, genuinely useful things. Second, a claim on future productivity – your own, or that of others. That’s where money comes in, of course, since it is a convenient symbol for such claims. Both forms of wealth involve uncertainties. Can you hang on to those useful possessions, and will they continue to be useful as your situation changes? Can that claim on future productivity be enforced and will that productivity stay at the level you are relying on. Currently, much of our productivity is based on access to cheap energy. Maintaining some level of productivity that doesn't rely on fossil fuels is going to be the challenge in the years to come.

After having said all that, it should be no surprise that, based on my expectations of continued deflation and the illusory performance of the markets, I have moved my modest investment portfolio to cash. This amounts to keeping one’s options open in an uncertain situation, always a good idea. Of course, cash investment don’t return much these days – not even keeping up to the current low level of inflation. It’s basically a decision to loose this money slowly rather than quickly. And in the meantime have at least some of it available to use for preparations that I think are more likely to pay off.

Another thing to consider is moving one’s money from big banks to local credit unions. Here in Canada, all the credit unions are striving to turn themselves into big banks, merging with each other and chasing the illusory advantages of “bigness”. So this may or may not be a viable strategy.

One thing that is certain is that debt amounts to signing over your claim to your own future productivity to your creditors.

As I have already said, the growth economy uses debt to create money. Debt also serves to trap us within that economy. I think for many people, one of the attractions of the idea of collapse is a wiping clean of the slate and a fresh start for those who survive, especially when it comes to debt. Of course, this is a fantasy. Many have suggested that a jubilee, a mass forgiving of debts, can solve our economic problems. But remember, your debts are someone else’s wealth. So, debtors’ prisons are another “solution” that I think is equally likely to be used. The key is to not get any further into debt and to expend every effort to pay off the debts we already have.

It has been interesting to watch attitudes toward debt change over the last few years. We started out thinking that debt was the key to getting the best out of life – even toys and vacations could be put on credit. Then it was only investments that could pay themselves back – a house, an education, a business. Then the housing bubble in the States burst and even here in Canada is peaking out, and houses don’t seem like a very good investment; maybe not even as a place to live. Saying that borrowing for an education isn’t wise has been a big step, but now it’s pretty clear that for most students, it just isn’t paying off. And as for borrowing money to start a business – well, good luck finding a bank that will take you seriously.

One of the best justifications for the serious austerity measures I am discussing here is to have some spare cash that can be applied to one’s debts.

As moving goods around the world is becoming more expensive (and forcing us to relocalize), so is moving people. It looks like we will be doing much less long distance travel. Flying is already becoming more expensive and less convenient, and this can be expected to continue until it will be a thing of the past for most of us.

What about cars? It is easy to lose sight of the costs of operating a car and forget that in many cases the benefits may not justify those costs. My out of pocket costs to operate my car are around $5000 a year. If I plan to do so on an ongoing basis, I have to save quite a bit every year so I can afford a new car when this one wears out, that or borrow the money; say $10,000 every year all told.

I am retired from my first career and now work at home. I’m fortunate to live in a small community where walking is pretty practical. It is an hour or two drive to anywhere away from here, but we don’t make that many out of town trips, certainly not daily, often not even weekly. For what I currently pay just to operate my car, I could rent a vehicle when I absolutely need it and have money left over at the end of the year. Quite a lot of money.

Of course, many people live far from work, far from shopping, far from their children’s schools, far from their extended family. Under such circumstances owning a car, probably two of them, seems like a necessity. But turn it around – maybe it’s more of a case of you working for the cars and wasting a great deal of your time driving them back and forth. Seen in that light, rearranging one’s life to be less car dependent starts to sound like a good idea. And that’s without considering the risk involved in driving and all the externalized costs we don’t pay for directly.

I know many people who are driving older cars, are putting away no money towards replacing them and could not afford a major repair bill. They are already teetering on the edge of having to do without a car, and desperately need to find a way to do this. I think at some point most of us will be faced with this decision, as our incomes decrease and the cost of cars, fuel, maintenance and insurance rises along with all our other expenses. Better to have made the transition deliberately than be forced into it by the loss of a job or an expensive mechanical failure.

Along the road to car-less-ness, there are many intermediate solutions that will reduce our reliance on fossil fueled personal transportation. Cutting back from two cars to one, car pooling, car sharing, car co-ops, occasional renting, public transit, bicycling, walking, working at home – to name but a few.

One thing that grew with the economy over that last half of the twentieth century was the size of our homes. This culminated in “McMansions” – those 5000 square foot homes with 5 bedrooms and six and a half baths, most not built to be energy or water efficient, and typical occupied by families of three or four people. The dream was that they would continue appreciating in value forever and thus were the best investment you could make.

And indeed, before the end of growth, investing in real estate seemed like a sure bet. Especially in a primary home, when one had to have a place to live anyway. Even borrowing and paying several times what your home was worth in interest on a mortgage was reasonable, since at the end you could sell the place and have a nice chunk of cash to help with your retirement. This is no longer necessarily the case. For many people, owning even a modest home may be a poor bet in a deflationary economy.

When house prices are declining, one is better to hold onto one’s cash and wait for the market to bottom out. At that point, anyone lucky enough to have cash left on hand will be able to have their choice of some real bargains in real estate. If prices in your area are still rising – that is, the bubble has not yet burst – best to get out before it does. If you bought your home years ago and it is already paid off, this isn’t such a worry. But then you have to wonder if your income declines, will you be able to cover property taxes and maintenance.

I know many young people for whom buying a house is not even remotely an option. In many areas, the available jobs will hardly cover rent. In such a situation, living with one’s parent is nothing to be ashamed of, provided you pitch in with household chores and help out with expenses to whatever extent you can. This is becoming more common, and no doubt the trend will continue. Or get together with some friends and share the rent on a place with several bedrooms. This can be a real learning experience and a wonderful way to find out how mature your friends are. Some people seem to think that lots of personal space and a private bedroom and bath are necessities, but it seems that they are about to learn that nothing could be further from the truth.

The home has traditionally been the center of the informal economy, making a positive contribution to a family’s independence. But sometime over the past few decades, homes became an investment, to be maintained in pristine condition ready for sale at a tidy profit. A working home has become something to be ashamed of. At the same time, we have come to expect larger homes, with more amenities. There is little doubt that this is not sustainable in the long run and in the short run economic realities will force us to change.

Moving to a smaller home may be difficult if you’d be facing a huge loss on the house you’re living in. But filling some of those empty bedrooms with boarders or running a business in some of the underutilized space in your home is a practice that was common in the past but is frowned on or even prohibited by zoning regulations today. This is an example of attitudes and laws that simply don’t fit the new reality and that will need to change as that reality is forced on more and more people.

Similarly, many municipalities or homeowners associations will not allow you to have a clothesline, a rain barrel or a vegetable garden (especially in the front yard). Keeping farm animals (chickens, goats, even rabbits) is almost universally forbidden in urban settings. I’d like to think that the day will come when this will change and you may get a break on property taxes for these things because they show that you are less of a burden to the community.

A home should be set up to waste as little as possible -- water, and energy for heating and air conditioning are the easy targets for improvements that can pay for themselves and go on to save money in the long run. Some energy saving steps such as sealing drafts around windows and doors can be done at a very low cost and make a big difference. Awnings to shade south facing windows in the summer and insulated blinds or insulated inserts for windows in the winter can make a big difference as well and don’t cost a lot if you make them yourself, which isn’t terribly hard to do.

If you don’t have cash available for such improvements (and even it you do), it’s time to learn how to survive without air conditioning and with the thermostat set a lot lower in the winter time. The key to this is remembering that the human body can and will adapt to a wide range of temperatures – if it is given a chance to do so. Nothing is more certain to make summer temperatures unpleasant than spending part of your time in air conditioned spaces.

The relocalization of food is something that can be done at a family and individual level, and it is a valuable response when we find our budgets getting tighter and food prices going up. The first thing is to bring food home. I am told that there are areas in the US where it is actually less expensive to eat at fast food outlets than to buy real food and cook and eat it at home. I find this hard to believe – it certainly isn’t the case where I live and I suspect those who are making those claims do so in ignorance of how economical it can be to cook from scratch.

So, I think we’ll be forced to eat out less and eat less in the way of highly processed convenience foods at home. As unemployment increases the odds are that there will be someone at home who can take the time to cook with basic ingredients. The time spent doing so pays off nicely, in my experience. The ability to do so is a valuable skill and the equipment required is really pretty basic (and not expensive).

While learning to cook from scratch, start keeping a well stocked pantry – enough to get you through a few weeks when cash is short without having to go hungry. This also allows you to take advantage of sales and better prices on larger containers or bulk buying. It is also pretty handy to have what you need to cook a meal already on hand, eliminating last minute runs to the store. And it is also a basic step in emergency preparation. It can be a challenge to do if you are already short of cash, but well worth some sacrifices.

I guess next on the list is buying food when it is in season (and available at a lower price) and preserving it to eat when it is out of season. Some foods such as grains, dried legumes and winter squash are dead easy to store, requiring nothing more than a cool dry place. Root vegetables, in particular potatoes, can easily be stored in a root cellar, which is really pretty easy to set up if you are living in a house. More of a challenge for apartment dwellers, obviously. Other foods can be dried, pickled, frozen or canned. These technologies take more equipment and skill but the investment can pay off very well in increased food security and financial savings.

Of course you can store or preserve what you buy at the supermarket, but where this really leads us is to finding local farmers and becoming direct customers of theirs, cutting out the middleman and raising the possibility of having both higher prices for the producer and lower prices for the consumer. A little extra effort may be required on both parts, but with a good return. Especially for fruits and vegetables that have a definite season this can lead to big savings on excellent quality products.

I would also recommend becoming a local grower yourself and starting a garden. This is a prime example of investing your time in the informal economy and reducing your dependence on the formal economy. If you don’t have space, try plants in containers on your balcony or porch, get involved in your local community garden or see about borrowing some garden space from someone who has too much to handle.

In the age of growth, education was available to more people than ever before. Governments and businesses saw the benefits of an educated populace and had the surplus resources to make it happen. Those surplus resources are disappearing and already education is becoming more expensive, or being delivered in a watered down form. Not too long ago, businesses were proud of their training programs, now they won’t hire anyone who is not only trained but also experienced, and at the same time complain about the lack of such people. Of course, this is less an indication of how unreasonable businesses are than a clear measure of the tight spot they find themselves in now that the economy has stopped growing.

In any case, the world is changing so fast that going to school and graduating with some sort of qualification is no longer a guarantee of employment. Traditionally this wasn’t the point of education anyway and things are swinging back in that direction again. At an intellectual level, learning how to learn is more important – once you’ve done that, you can teach yourself what you need to know in the situation you find yourself - especially for as long as the internet is available. At a more practical level there are many skills that would be very helpful in the process of relocalization. But those skill are being lost as the people who once practiced them grow old and die. Some time spent learning such skills, by seeking out those who still know them and by trial and error, should pay off nicely.

What with growing unemployment caused by the contraction of the economy it’s pretty reasonable to worry about job security. Even with all the measures I’m talking about here to reduce our reliance on the formal economy, it’s hard to see how to get by without earning some money. Getting and keeping a job is going to be even tougher in the years to come, especially in the “FIRE” industries: finance, insurance and real estate. Similarly for those industries that will be hit hard by the rising cost of energy – like the airlines, the trucking industry, automobile manufacturing, road construction, industrial agriculture and so forth. It’s tempting to look around for what the next big boom will be – all the talk about growth in green industries is based on that idea. But growth, as I’ve been saying, is a pretty dubious notion. For decades now all you had to do was identify which train was heading in the right direction and hop aboard for what you could expect was a fairly easy ride. I think that sort of train has stopped running. No doubt there will be new jobs related to the relocalization of much of our vital industries, but instead of a train to hop, this will be more like putting your hand to the wheel of a cart, and in many cases one which is heading up hill. But there will be work for those with the skills to grow, make, build or fix things that people actually need.

If we are really going to replace industrial agriculture with small scale, “agroecological” farms, then a lot more people are going to have to be involved in growing food, which should help with unemployment. Other relocalized industries will likely involve fixing and reusing the “stuff” that we will no longer be able to afford to throw away when it breaks or wears out. So there will be opportunities for those with skills at salvage, repair and refurbishment.

Convince someone today that we are facing the sort of problems I’ve been talking about on this blog and they are liable to ask you what they need to buy in order to be prepared. Of course one answer to that is that too much buying is one of the causes of the problems we face – we need to consume less and more carefully. But for the last few decades “stuff” has been cheap and readily available and we’ve all been cast in the role of consumers of that stuff. Industry, driven by cheap energy from fossil fuels, have been desperate to find a market for everything they could make, regardless of whether there was a real need for those products. So a great deal of effort has been made to convince us that all we really need to be happy and fulfilled is more stuff. And my, is there ever a lot of good stuff available and easy credit so that one doesn’t have to worry about saving up to be able to afford it. This is even a good thing is some ways – along with all the cheap plastic junk there are lots of high quality items that no doubt would be useful to have, if we could just find time to use them.

But the situation is changing and it is going to hurt those of us who need a good shopping fix now and again or who believe that success and self-worth is measured by the number of toys you have. Whether it’s because the economy has slowed down so much that what you’re after isn’t being made anymore or whether you can no longer afford it, it’s not going to sit well with people who grew up being able to buy whatever they wanted, whenever they wanted it. We’ll need to learn to waste less, use less, fix what’s broken and take care of what we have so that it lasts longer. And to find fulfillment from something other than the latest gadget or fashion, even if we are convinced that we “really do need it”.

Entertainment, during the twentieth century, took on a role similar to that of stuff. With the invention of radio, TV and then the internet, entertainment became readily available, and more a matter of passive consumption than it ever had been in the past. When the economy was growing and there was lots of surplus wealth, it became the basis of a thriving industry, providing us with diversion in large and never ending quantities. Like stuff, there is lots of junk entertainment, but also some that is really good – and more of it than there ever was before. as well.

In the age of scarcity, though, we may find ourselves having to make more of our own amusements. For many this will come as a huge shock, and as boredom sets in, the world may seem a much less enjoyable place. Once again, better to be prepared in advance, and learn to entertain ourselves without the aid of the mass media.

I’ve been trying to present deliberate descent as a practical adaptation to a challenging situation, which will in any case involve “involuntary descent” if one doesn’t get ahead of the game. Especially at the individual level it can be applied, to at least some extent, without the co-operation of those around us. And while you may be able to detect my own personal political leanings from what I have been saying here, what I am suggesting will work for people from all political persuasions because it is simply a pragmatic response to the situation in which we are all finding ourselves. It doesn’t really matter how you think we come to be in this situation, the important question is “what do we do now” and deliberate descent provides immediately applicable answers to that question.

Many people put their faith in political activism, hoping to convince those who are in power to solve the problems that they are concerned about. This may even work at times, but I have very little faith in it. Our current power structures, regardless of what political labels they operate under, are actually the source of many of our problems. No amount of fine tuning of the system is likely to fix the problems that the system is, by its very nature, causing.

Better to take one’s own situation in one’s hands, take a realistic (and inevitably somewhat pessimistic) view of what lies ahead and get ready to cope with it.

In my next post I'll be talking about where this idea of deliberate descent might take us – what its consequences might be it it became popular.

In the meantime here is a link to some great resources on in living times of scarcity:

BETTER TIMES ACCESS TO SUSTAINABLE, SIMPLE, & FRUGAL LIVING.

And in case you don't stumble upon it among the many links on that website, here is a page with links to a set of printable flyers that contain extremely valuable information for coping with

various sorts of emergencies. Worth printing out and putting in a safe place (after you read them).

Thanks for this go to Bob Waldrop, moderator of the Yahoo group "Running on Empty 2".

This is the second in a series of three posts:

- Deliberate Descent - Part 1 , Sunday, 18 August 2013

- Deliberate Descent--Part 2 , Saturday, 24 August 2013

- Deliberate Descent, Part 3, Saturday, 22 March 2014